Introduction

As the burden of student debt continues to weigh heavily on millions of Americans, choosing the right loan provider can make all the difference. Earnest, a well-known fintech company founded in 2013 and acquired by Navient in 2017, has gained significant attention for its flexible and transparent loan products. This in-depth review examines everything you need to know about Earnest loans — from refinancing options and eligibility requirements to interest rates, borrower experience, and more — to help you decide whether Earnest is the right choice for your educational financing needs.

Overview of Earnest

1.1 Company Background Earnest was created to disrupt the traditional student loan market by offering a customer-focused, technology-driven experience. It offers both student loan refinancing and private student loans for undergraduates and graduates.

1.2 Mission and Values Earnest promotes financial literacy, transparency, and personalized service, aiming to empower borrowers with smarter tools to manage their debt efficiently.

Types of Loans Offered by Earnest

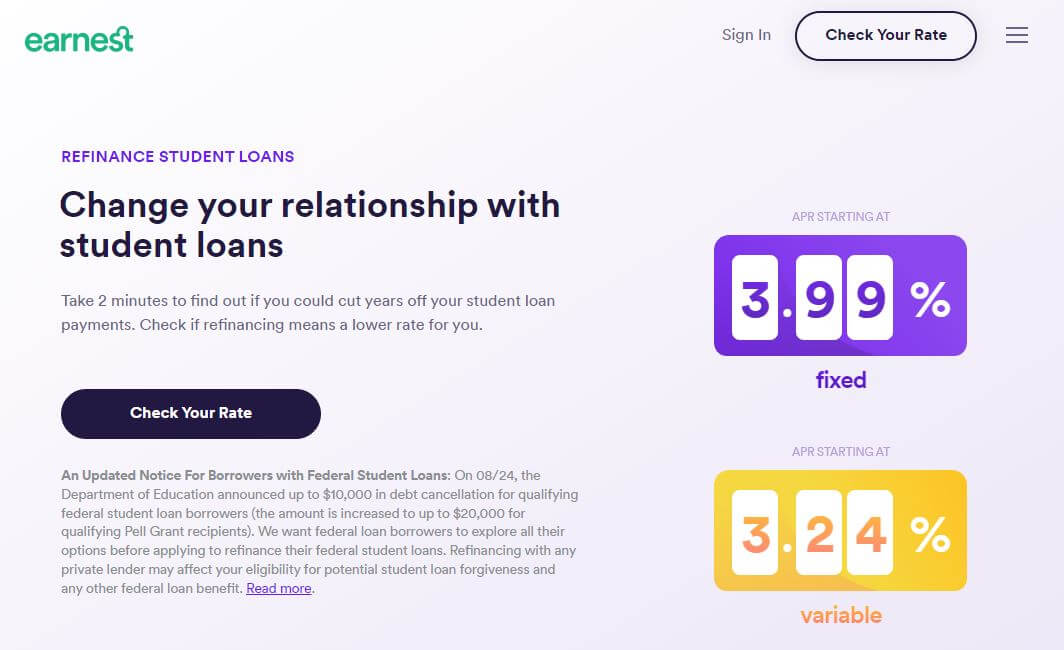

2.1 Student Loan Refinancing Earnest allows borrowers to refinance existing federal and/or private student loans into a single new loan, often at a lower interest rate.

2.2 Private Student Loans Designed for students who need additional funds to cover educational costs not met by federal aid, Earnest’s private loans feature customizable repayment plans.

2.3 Cosigner Release Currently, Earnest does not offer cosigner release, which is a downside for students relying on a creditworthy individual to qualify.

Eligibility Requirements

3.1 Basic Criteria

- Must be a U.S. citizen or permanent resident

- Must reside in a state where Earnest operates (all except NV)

- Minimum credit score: 650 (for refinancing)

- History of on-time payments and steady income

3.2 Unique Evaluation Process Earnest evaluates applicants holistically, factoring in savings patterns, spending habits, and career potential — not just credit scores.

Interest Rates and Fees

4.1 Refinancing Rates

- Fixed APR: 4.99% – 8.99% (with autopay discount)

- Variable APR: 5.89% – 9.74% (with autopay discount)

4.2 Private Student Loan Rates

- Fixed APR: 4.99% – 13.03%

- Variable APR: 5.89% – 13.27%

4.3 Fees Earnest prides itself on having no origination fees, late fees, or prepayment penalties, making it a cost-effective option.

Repayment Flexibility

5.1 Customizable Payments Earnest allows borrowers to choose their own monthly payment amount (within a certain range), giving more control over their budget.

5.2 Skip a Payment Feature Borrowers in good standing can skip one payment every 12 months, which adds flexibility in times of financial strain.

5.3 No Deferment for Refinanced Loans Unlike federal loans, refinanced loans with Earnest do not offer deferment options for returning to school or military service.

Application Process

6.1 User-Friendly Interface The application process is entirely online, streamlined through a clean interface that allows for real-time rate checking without impacting your credit score.

6.2 Documentation Needed

- Government-issued ID

- Proof of income/employment

- Loan statements (for refinancing)

- School information (for private loans)

6.3 Time to Approval Most borrowers receive approval within 5-10 business days, with funds disbursed shortly after.

Pros and Cons

7.1 Pros

- Competitive interest rates

- No fees

- Customizable payment options

- Skip-a-payment feature

- No hard credit pull for rate estimate

7.2 Cons

- No cosigner release

- Limited hardship assistance

- Not available in Nevada

- No deferment for refinanced loans

Customer Support and User Experience

8.1 Customer Service Options Support is available via email, phone, and live chat. Earnest generally receives high marks for responsiveness and clarity.

8.2 Online Tools and Resources Earnest offers an intuitive dashboard for managing loans, budgeting tools, and an extensive blog on personal finance topics.

8.3 User Reviews and Ratings

- Trustpilot: 4.7/5 stars

- Better Business Bureau: A+ rating Many customers highlight ease of use, competitive rates, and exceptional service.

Comparison with Other Lenders

9.1 Earnest vs. SoFi

- SoFi offers more comprehensive benefits like career coaching but tends to have higher minimum loan requirements.

9.2 Earnest vs. CommonBond

- CommonBond has a social mission but offers fewer flexible payment features compared to Earnest.

9.3 Earnest vs. LendKey

- LendKey connects borrowers with community banks and credit unions; Earnest offers a more unified digital experience.

Is Earnest Right for You?

10.1 Ideal Candidates

- Financially responsible borrowers with consistent income

- Those looking for flexible repayment terms

- Graduates with multiple student loans seeking consolidation

10.2 Who Should Look Elsewhere?

- Students needing a cosigner release

- Borrowers seeking federal loan protections

- Those ineligible due to geographic or credit restrictions

Conclusion

Earnest stands out in the student loan industry for its transparent pricing, innovative features, and borrower-centric approach. Whether you’re a recent graduate looking to refinance or a student needing private loan options, Earnest provides a strong suite of tools to manage educational debt effectively. While not perfect for everyone — especially those who require more robust hardship options or cosigner flexibility — Earnest is a top contender in today’s student lending landscape. Always compare multiple offers and consult a financial advisor before making a final decision, but for many, Earnest represents a smart, user-friendly solution to the student loan challenge.